How do you fix overpriced macro risk premiums?

DFI support mechanisms have tended to focus on the project-specific micro premium in cost of capital. But a report for the Climate Policy Initiative by Avinash Persaud (recently appointed IDB special climate advisor) demonstrates that it is the macro risk premium that is significantly upping developing market cost of capital – and by much much more than it should be. Uxolo talks to Persaud about his findings and the potential solutions.

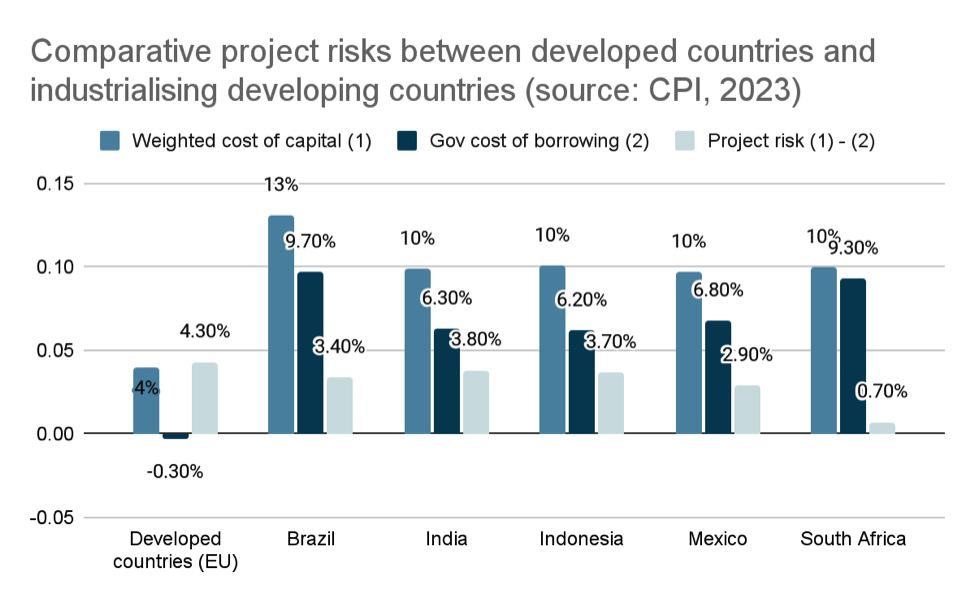

Cost of capital is a crucial metric indicating the required rate of return for investors to compensate for perceived risks. The basic constituents to arriving at cost of capital are the risk-free rate of return an investor requires, the macro-risk premium derived from political, sovereign credit and currency risks, and the micro-risk (risk attached to a specific project) premium. The macro-risk premium is easily identified by looking at the government cost of borrowing on its bonds – the micro-risk premium is the extra return above that rate needed to attract investors into specific projects.

A recent report by Avinash Persaud for the Climate Policy Initiative came to a number of new conclusions on cost of capital, most significantly that in industrialising emerging economies, excluding China, the micro-risk premiums are in fact similar to that in developed countries – it is the macro-risk premium which accounts entirely for the higher cost of capital.

So, while MDBs and DFIs have been focused on de-risking project/micro risks to bring down cost of capital for developing markets, the scope to do so is actually quite limited – macro risk premia have a much bigger impact than micro.

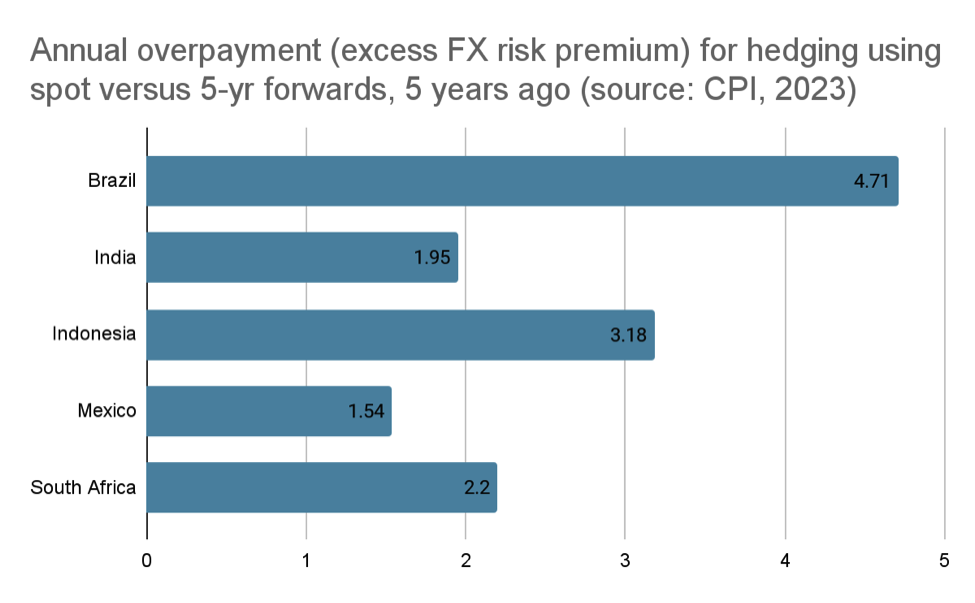

“A risk premium is meant to encourage investment by overcompensating risk-takers, but in this case that overcompensation is so great it is stopping projects that would be profitable and financed in developed countries,” says Persaud. In fact, he finds this overcompensation is leaving a historic legacy of overpayments, visible in the forward FX markets which act as a proxy for large macro risks: “If the forward FX market were efficient and transaction costs low, the cost of the FX hedge would over time and currencies, average close to the actual FX depreciation. Instead, we find a significant +2.2% per annum average ex post ‘overpayment’ for FX risks, with an overpayment occurring in 62% out of 371 five-year hedges between 1999-2022”.

Persaud concludes that a partial FX guarantee mechanism, limited to green transformation projects, could alleviate the impact of overpayments when they are most extreme and mitigate the worst effects of this “planet-sized” problem.

Developing a partial FX guarantee mechanism

IDB and Brazil’s Ministry of Finance have taken the idea on board, creating a platform with three abilities: full swaps, credit lines for foreign currency investments liquidity in the case of FX rate devaluations, and tail risk hedging mechanisms for extreme devaluations.

In his new role as special climate advisor at IDB, Persaud will be involved in the development of pilots, which he argues will make a vital difference to the flow of finance to the green transition. “We really need to not focus exclusively on project and sector risks where the scope for further reduction is, to be frank, now quite small. What we need to do is start dealing with the same attention to macro risk, like country and currency risk – that is something Latin America gets very quickly; if you’re a Brazilian or Argentinian or Peruvian central banker, you have lived with macro risk day in and day out.”

In his paper, Persaud suggests a mechanism could only be triggered when hedging costs were above the three-year average and then offer FX hedges three to four percentage points cheaper than the market offering – at this level, he argues FX risks would likely still be covered and investors’ currency-hedged returns would rise by 3-5% per annum into the critical 8% per annum zone, which would get institutional investors excited. IDB’s new platform, though not identical to Persaud’s idea, will stand as a test for how much private investment can be driven up. And IDB has ambitious aims in mind, stating it could potentially mobilise up to $3.4 billion through the mechanism, and this figure ‘may increase over time’.

However, Persaud adds that any platform will have to be careful to stay on the side of the line that is countercyclical lending and not cross over into handing out subsidies: “Subsidies would be welcome, but the scale of finance we need is too large for any solution that depends on them”.

He adds that while that should be the intention, there is the bonus that if the line were ever crossed accidentally by reducing the hedging cost too much, limiting project eligibility to only green transformation initiatives will mean any accidental subsidy will support a global public good.

The year of pilots

Persaud says he hopes 2024 will be the “year of pilots”, a period when MDBs and DFIs start testing out new financial innovations: “The agenda is set, the time is for implementation and acceleration. The nature of development is it is part of the fashion industry – these ideas are part of high fashion today – but the surest way to make this fashion look stale and be discarded is if we just keep talking about it and don’t try it.”

He recognises such try, fail, and try again mindsets are not necessarily natural to MDBs which have historically been very conservative institutions. However, he states “entrepreneurial leaders like Ajay Banga and Ilan Goldfjan are an essential part of the transformation”, and mechanisms like debt pause clauses, currently in discussion at the World Bank for implementation across both new and existing loans, and the IDB’s partial FX guarantee mechanism and CLIMA initiative are promising signs of real change in the MDB system to come.

These initiatives are also an indication of a new way of development finance thinking. “Development banks tend to be project-finance based, doing one project at a time. They are new to saying: this is what needs to be done for the whole country to be resilient. That requires a different approach, different modalities, and some more joined-up thinking”.

The IDB CLIMA pilot is a promising example, offering sovereigns a 5% discount in the form of a grant on loans which achieve large-scale climate objectives – with a $1 billion initial lending envelope, the scheme has plenty of potential to mobilise grant capital from third parties, like philanthropists: “A lot of philanthropic capital is put into initiatives in the hope they will be successful, but CLIMA only needs your capital once targets have been achieved – this might be the killer app to untap more of that money”.

All of the ideas out there – from portfolio guarantees to hybrids to debt for nature swaps to those above – need to be experimented and improved upon, says Persaud, in order to see the massive catalytic expansion development finance needs. But one final point he makes is MDBs still need additional shareholder money: “Part of the Bridgetown Initiative states we need to $100 billion of new capital spread over ten years, which means for a country like the UK you would contribute just $400 million a year – that is transformation on the cheap, it would allow for the tripling of MDB balance sheets and would account for the whole resilience layer of climate finance. This can, and should, be done”.