Indorama blue loan lays marker for Asian corporates

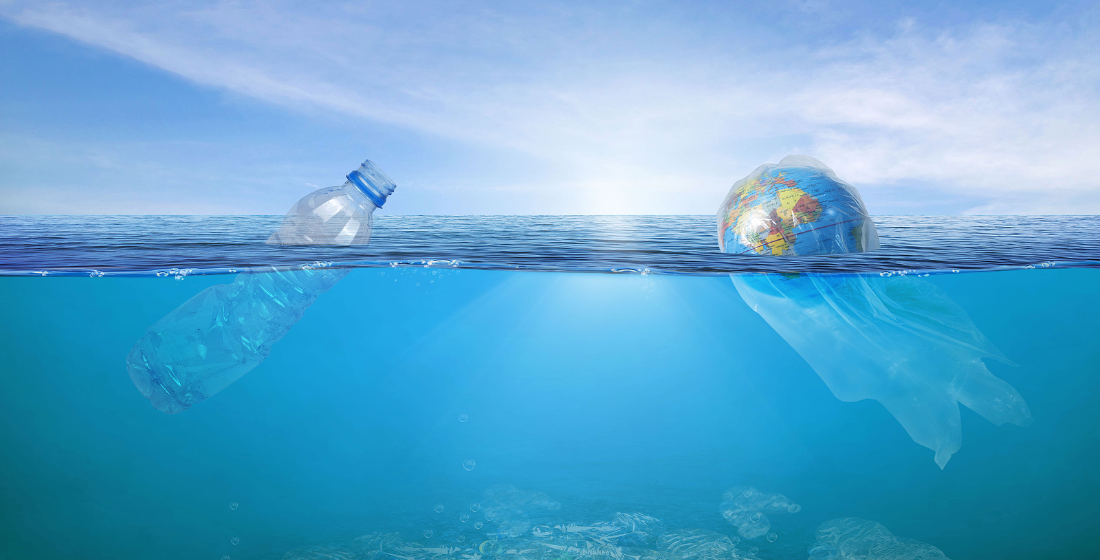

ADB, DEG and IFC have provided a $300 million financing that will fund the recycling of 50 billion plastic bottles every year by 2025, diverting plastic waste from landfills and oceans across four countries in Asia and one in Latin America.

At the end of November, ADB, DEG and the IFC teamed up on a landmark $300 million financing for Indorama Ventures, a Thai-listed global producer and recycler of polyethylene terephthalate (PET) resin – widely used in the manufacturing of plastic bottles.

The financing was the first-ever ‘blue loan’ to a global plastic resin manufacturer and the proceeds will fund the recycling of 50 billion PET bottles every year by 2025, diverting plastic waste from landfills and oceans across four countries in Asia and one in Latin America.

“This deal really creates a marker in the Asian market for the ability to get a structured, certified blue loan done,” says Chris Bishop, a Singapore-based partner at law firm Allen & Overy, which advised the lenders in the transaction. “Blue loans and social loans are a little bit harder to structure than green loans because they don't have the same standardised terminology from the LMA (Loan Market Association) and APLMA (Asia Pacific Loan Market Association). So anything other than a green loan in Asia and you’re feeling your way a bit – but this shows it can be done.”

Uncharted waters

A blue loan is a financial instrument where the funds raised are certified to support the sustainable use of ocean resources for economic growth, improved livelihoods and jobs, and ecosystem health.

The financing package comprised a $150 million senior loan from IFC and parallel loans amounting to $150 million from ADB and DEG. The loans were tied together through a common terms agreement for a single transaction.

“With this loan being the first blue loan in the sector, there was a lot of energy on all sides to get the deal done,” recounts Bishop. “The three lenders all had their own ESG policies that needed to be met so that obviously took some negotiation with the borrower. Particularly with the blue loan aspect involved too, those negotiations needed a lot more time and focus – rather than just rolling out a typical loan template.”

Norway-based DNV GL verified the facility as a blue loan complying with the Green Loan Principles, with reference to the Blue Natural Capital Financing Facility’s Blue Bond Guidelines.

“What would help for more blue loans going forward would be a further alignment of APLMA’s blue loan standards with those of the EU Taxonomy,” says Bishop. “They’re a little bit behind in Asia in that regard, so the regulators and participants will need to try to find further alignment on those standards. Going forward, that would expedite the completion of blue loan transactions.”

Creating value out of ocean waste

Indorama will use the funding to increase its recycling capacity in Thailand, Indonesia, Philippines, India, and Brazil – countries that are grappling with mismanaged waste and serious plastic waste in the environment – as well as to invest in renewable energy and resource efficiency projects.

The firm is aiming for a minimum of 750,000 metric tons of recycled PET (rPET) globally by 2025. A key feature of the investment is to create value out of waste processing post-consumer PET bottles that would have ended up in landfill or been processed into lower-value products – by promoting higher-value bottle-to-bottle recycling which brings significant value-generating potential.

"Our company is building the recycling infrastructure needed to divert waste from the marine environment,” said Indorama’s chief sustainability officer, Yashovardhan Lohia, at the loan’s signing. “By recycling post-consumer PET bottles into new bottles, we give waste an economic value. This drives improvements in waste collection systems, meaning less waste and cleaner oceans."

Indorama will use the funds to invest in other climate-related activities; installing more solar panels at facilities in Thailand and India, while also securing more renewable energy for its manufacturing facilities. The company is working on a Waste Heat Recovery (WHR) project at its PET and fibre manufacturing facility in Indonesia where energy efficiency (EE) measures are expected to reduce the facility's carbon footprint by as much as 25%. It will also develop WHR and EE projects in Brazil and other manufacturing facilities to meet its corporate targets.

“We’re seeing this more and more from corporates in Asia: a desire to lead on ESG issues and to really make the investments to back those plans,” says Bishop. “The speed with which the Asian market has developed in the recent decades has been extremely rapid and a focus on growth has been the primary focus for businesses. But what we’re now seeing is a generation of business leaders come through who prioritise the environment and the community much more in that equation. So seeing a company as significant as Indorama taking this approach will reverberate throughout the market and you will definitely see other Asian corporates following suit.”

Indorama is certainly a seasoned developer and must have a reason for taking on what the parties to the deal claim is the additional hassle of negotiating a blue loan rather than a traditional debt facility. What that reason is remains under wraps. None of the participants will reveal the tenor on the deal or cost of debt, citing the borrower’s listed status – so it’s hard to say if there is any tangible financial benefit to going the blue route, or what the difference is between this ‘blue’ project and any other PET recycling scheme. Indorama may be carrying the ‘blue’ flag into Asian plastics, but transparency from DFIs on any cost-of-debt, tenor and covenant benefits for sponsors doing these colourfully labelled ESG types of deals would likely have a bigger impact. Forget the colours and go for crystal.